Managing your budget effectively is a never ending balance of grow v save v risk v return. It’s about finding that sweet spot between investing in growth and maintaining financial health. At The OMG Center, we understand that budget management isn’t just about keeping the numbers in check; it’s a strategic endeavor that fuels your business’s growth while safeguarding against financial overreach.

In this article, I’m going to explore the art and science of budget allocation in the context of a growing business.

Imagine for a moment

As the leader of a growing business, you’re constantly balancing the need to invest in growth with maintaining financial health. Decisions about where to allocate your budget – be it in expanding your team, upgrading technology, or exploring new markets – are critical.

You find yourself grappling with questions like how much to reinvest in the business, when to scale operations, and how to ensure that spending drives growth without financial overreach. Your budget is the key to fueling your business’s future, but navigating the complexities of financial planning can feel like a labyrinth, with every turn impacting your business’s long-term success.

Have you ever…

?- …felt uncertain about how much of your profit should be reinvested back into the business?

?- …wondered if your current budget allocation truly aligns with your business’s long-term goals?

?- …questioned whether you’re over-investing in certain areas while neglecting others?

?- …felt that your budgeting decisions are more about ‘keeping up with the competition’ rather than based on your business’s unique needs and capabilities?

?- …experienced anxiety over a major financial decision, unsure if it was the right move for your business’s growth trajectory?

Has…

?- …there ever been a time when a significant investment in a new tool or service didn’t yield the expected return, impacting your overall budget?

?- …your business ever faced a cash flow crunch because of overcommitting funds to one aspect of the business, like marketing or new hires?

?- …a sudden market change or client loss ever left you wishing you had a more robust financial safety net or contingency plan?

?- …you ever missed out on a growth opportunity, like hiring a key talent or capitalising on a market trend, due to a lack of available funds?

?- …your team ever expressed concerns or frustrations about inadequate resources or tools, impacting their efficiency and morale?

If any of this resonates, maybe the below might be helpful…

In the below section, I’ll try to offer some ideas, areas to look into, and tools that might help you out.

Cashflow Forcast FTW.

How many of you reading this have an up-to-date cashflow forecast?… Liars. I’m confident many of you have created one at some point or another, but how many of you regularly work from it and keep it up to date?

If you have, and importantly use, a proper cashflow forecast it will help you:

👉 – Predict Shortfalls: Identifying potential future cash shortages to better plan ahead with less worry.

👉 – Budgeting: Aiding in effective budget planning and allocation for yourself of department heads.

👉 – Decision Making: Informing strategic business decisions.

👉 – Investment Planning: Timing and planning for major expenditures to minimise risk or maximise yield.

👉 – Managing Growth: Supporting sustainable growth strategies, or just knowing you’ll have the cash if needed.

👉 – Stakeholder Assurance: Providing confidence to investors, lenders or partners.

👉 – Risk Management: Identifying financial risks and preparing contingencies.

There are a few ways to build your own forecasts, personally, I prefer building my own in Excel as it allows more flexibility. That said I’ve also used a great app called Float which connects directly to Quickbooks and Xero etc. I wholly recommend this gets done properly and used rigorously. To do this, speak with Magic Digits, our OMG Partner. If you want to build your own, at least as a starting point, follow the below basic instructions:

1️⃣ – Export Profit and Loss Statement

2️⃣ – Identify Income Sources: On the P&L, list all your income sources (e.g., clients, fees and commissions).

3️⃣ – List Expenses: Note down all expenses (e.g., salaries, rent, utilities).

4️⃣ – Show your Gross and Net Profits

5️⃣ – Adjust for Non-Cash Items: Like depreciation from your net profit.

6️⃣ – Add expected Receivables and Payables.

7️⃣ – Project Future Months: Using past trends and future expectations, project income and expenses for the next months.

8️⃣ – Calculate Monthly Cash Flow: For each month, subtract projected expenses from projected income to get monthly cash flow, which starts calculating from a closing account balance.

9️⃣ – Summarise: Add up monthly cash flows to view your overall cash flow forecast.

To sense-check what you’ve built, or to build from a template, I’ve built this for you. If you use it, you need to say thanks on Social Media 😉!

Profit First…

There is an epic book that changed how I view my businesses, it’s called Profit First by Mike Michalowicz. The basic breakdown of the book (get a copy here) is a new/novel approach to managing finances in a business.

One key thing to keep in your mind is that the money in the business is not your money, until you pay yourself.

The core principle is simple yet profound: instead of following the traditional formula of Sales – Expenses = Profit, it flips the equation to Sales – Profit = Expenses. This means you take your profit first, then manage your expenses with what’s left.

The book outlines a practical, step-by-step system to implement this approach:

👉 – Set Up Multiple Bank Accounts: Set up several bank accounts for different purposes – one for profit, one for owner’s compensation, one for taxes, and one for operating expenses.

👉 – Allocate Percentages to Each Account: Upon receiving revenue, you immediately allocate predetermined percentages to each account. This ensures that profit is not an afterthought but a priority.

👉 – Remove Temptation: By physically separating money into different accounts, it becomes harder to use funds meant for other purposes, like dipping into the profit to cover expenses.

👉 – Regular Reviews and Adjustments: Regularly review your financials and adjust the allocations as needed to ensure the business is operating efficiently and profitably.

👉 – Focus on Cutting Costs: With limited funds in the operating expense account, you’re forced to scrutinise and cut unnecessary expenses, leading to a more lean and efficient operation.

👉 – Rewarding Profit Distribution: Quarterly, take a portion of the profit account as a reward or reinvest in the business, providing tangible benefits to the discipline of following this system.

ROI Assessment Techniques

Return on Investment (ROI) assessment is a crucial metric for any business. Understanding ROI helps you evaluate the effectiveness of your investments, whether in marketing campaigns, new technology, or hiring. By measuring ROI, you can make informed decisions about where to allocate resources, ensuring that every pound spent contributes to your business’s growth and profitability.

A Concise Guide:

👉 – Define Clear Goals: Set specific, measurable objectives for each investment.

👉 – Track Investment Costs: Record all costs associated with an investment, including indirect expenses.

👉 – Measure Performance: Use metrics relevant to the investment, like increased sales or improved efficiency. An example of this would be a new PM tool like ClickUp and measuring capacity over time or client retention related to operational improvements.

👉 – Compare Against Objectives: Evaluate if the investment met, exceeded, or fell short of your goals.

👉 – Use ROI Formula: Calculate ROI by dividing the net profit from the investment by its total cost.

👉 – Regular Review: Periodically reassess your investments to ensure ongoing alignment with business goals.

Learn and Adjust: Use ROI insights to refine future investment strategies.

It’s easy to forget to look back when you’re running a business, the relentless push forward often means the only retrospective you get is your tax accounting 🤮. Making a formal process of reviewing an investment in the business will mean that when your team ask for resources, they know they’ll need to prove the value too.

Proper Management Accounts

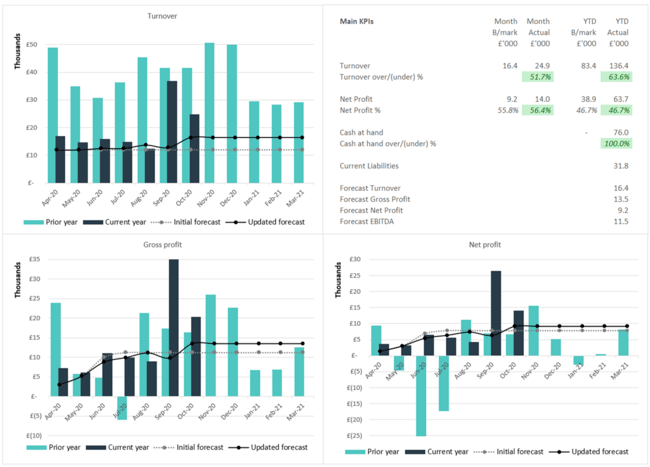

This is something that should come from the top, so to speak. Management accounts are like your “dashboard” figures that show your financial health as a snapshot in time. They’re usually best updated once the previous month is closed out, so week one of a month you see the previous month. In the dashboard you should be showing the core numbers that are important to your business that, if you needed to dive deeper, help to diagnose where positives or negatives are coming from.

They help you make quicker decisions by not getting into too much detail as well as provide a top-level view of how things are going. The key thing is to keep is as simple, yet informative as possible. An example is below, and this is based on one of our OMG client templates as part of our Accelerator Programme:

Financial Scenario Planning

Financial scenario planning is a critical exercise for ALL business leaders, whether you’ve been around for an age, or a month. It involves creating and analysing ‘what-if’ scenarios to prepare for various financial situations. This proactive approach allows you to anticipate potential challenges and opportunities, ensuring that your business remains resilient and adaptable in the face of change. By engaging in scenario planning, you can make informed decisions that safeguard your business’s future. Think of it as additional tabs to your cashflow forecast sheet that have modifiers for situations. Some modifiers might be a percentage, like an average cost increase to the business, whereas some might be hard figures, like the loss of revenue or changes in market conditions that you can put a whole number on.

Starting with your Cashflow forecast:

👉 – Identify Key Variables: Determine factors that could significantly impact your finances (e.g. market changes, client acquisition).

👉 – Develop Scenarios: Create realistic scenarios for different situations, such as economic downturns or rapid growth.

👉 – Analyse Impact: Assess how each scenario could affect your business’s cash flow, profitability, and growth.

👉 – Plan Responses: Develop strategies for each scenario, including contingency plans and growth strategies.

👉 – Regular Review: Update and review scenarios regularly to reflect changing market conditions and internal dynamics.

👉 – Communicate Plans: Ensure your team understands the scenarios and the corresponding action plans.

You don’t have to go to the Nth degree on this, with hundreds of scenarios, just plan for the core ones. A plan made now saves stressing and worry later.

Effective Cost Control Strategies

Effective cost control is REALLY important for maintaining the financial health of your business. It’s not just about reducing expenses; it’s about optimising your spending to ensure maximum efficiency and profitability. That can sometimes mean putting off a spend, or spending sooner, depending on your cashflow forecast and needs. Implementing cost control strategies helps in maintaining a lean operation, freeing up resources that can be better invested in growth and innovation.

Key starting points:

👉 – Audit Expenses: Regularly review all expenses to identify areas for potential savings.

👉 – Set Budget Limits: Implement budget caps for different departments or projects.

👉 – Negotiate with Suppliers: Work on getting better deals from suppliers and service providers.

👉 – Invest in Technology: Use technology to automate processes and increase efficiency.

👉 – Employee Training: Train employees in cost-conscious practices.

👉 – Monitor Regularly: Keep a close eye on spending patterns and adjust strategies as needed.

Debt Management for Businesses

Debt management is a crucial aspect of financial planning for businesses, especially if you have big growth plans and need debt to kick it off. While debt can be a useful tool for growth, mismanagement can lead to financial strain. Effective debt management involves understanding the cost of debt, using it strategically for growth, and maintaining a balance that doesn’t hinder the business’s financial flexibility.

Concise Guide:

👉 – Understand Debt Terms: Be clear about interest rates, repayment terms, and potential penalties.

👉 – Strategic Borrowing: Borrow for growth-enhancing investments, not for covering operational shortfalls.

👉 – Debt-to-Income Ratio: Keep this ratio within a manageable level.

👉 – Regular Repayment Plan: Ensure timely debt repayments to avoid penalties and interest accrual.

👉 – Refinance if Necessary: Consider refinancing to take advantage of lower interest rates or better terms.

👉 – Monitor Debt Levels: Regularly review your debt levels in relation to your business’s income and assets.

It’s super super important that you don’t just go out and get debt to grow without properly talking it through with your accountant and if needed, your IFA. Sometimes debt can become a bit of a drug that you cannot get off easily, like with some invoice financing/factoring solutions for example. Be smart.

Employee Financial Training

Financially literate, from a business perspective and therefore effective employee financial training is an often-overlooked aspect of running a business. By enhancing your team’s financial literacy, you empower them to make more informed decisions that align with your business’s financial goals. This training can lead to more cost-effective operations, better budget management, and a deeper understanding of the business’s financial health among your team. This can also help them to understand some of the decisions you make over the course of a financial year.

Get it done:

👉 – Identify Training Needs: Assess the financial knowledge gaps among your team.

👉 – Customised Training Programs: Develop training programs tailored to your business’s financial practices.

👉 – Practical Workshops: Conduct workshops on budget management, cost control, and financial decision-making.

👉 – Encourage Financial Responsibility: Foster a culture where every team member feels responsible for the business’s financial health.

👉 – Regular Updates: Keep the team updated on financial goals, challenges, and achievements.

👉 – Feedback and Improvement: Encourage feedback from employees on financial practices and continuously improve training programs.

You’re best off having someone external come in and help with this as it will take you out of the equation and mean that you’re not worrying about giving incorrect information or causing awkwardness.

Aligning Compensation with Strategy and Forecasts

Ensuring that you align pay reviews, bonuses, and salaries with your business’s strategic goals and cash flow forecast is a huge part of maintaining financial health and staff motivation. It ensures that your compensation strategy not only rewards and retains talent but also aligns with your business’s financial capabilities and long-term objectives. Effective management of payroll expenses, which often constitute a significant portion of your budget, is key to balancing employee satisfaction with financial sustainability. This means you’re not having some staff getting ad-hoc increases or hard to plan pay-scales.

A Concise Guide:

👉 – Strategic Salary Framework: Develop a salary structure that aligns with your business’s financial goals and market standards.

👉 – Performance-Linked Bonuses: Implement a bonus system tied to individual, team, and business performance metrics.

👉 – Regular Pay Reviews: Schedule annual or bi-annual pay reviews, factoring in individual performance, business profitability, and market trends.

👉 – Cash Flow Forecast Integration: Ensure that salary increases, bonuses, and new hires are accounted for in your cash flow forecasts.

👉 – Transparent Communication: Maintain open communication with staff regarding the business’s financial health and how it impacts compensation.

👉 – Deferred Compensation Plans: Consider deferred bonuses or profit-sharing plans during tight financial periods, with payouts aligned with future cash flow improvements.

👉 – Employee Involvement: Involve employees in understanding the financial aspects of the business, fostering a sense of ownership and alignment with business goals.

👉 – Flexible Compensation Models: Explore flexible compensation models like profit sharing, stock options, or non-monetary benefits that align with your business’s financial situation and staff preferences.

👉 – Cost-of-Living Adjustments: Regularly adjust salaries to match the cost of living, ensuring your staff’s financial well-being.

👉 – Legal Compliance and Fairness: Ensure that your compensation policies comply with legal standards and promote fairness and equity within the business.

By looking into integrating these practices, you can create a compensation strategy that motivates and retains your talent, supports your business’s strategic and financial objectives, and adapts to changing economic conditions.

Prioritise Financial Responsibilities as Business Owners

For business owners, the challenge often lies not just in understanding financial responsibilities but in actively making and allocating time to manage them. It’s common for founders and senior management to become deeply involved in product or service-related issues, inadvertently neglecting the financial aspect of the business. This oversight can lead to dropped balls in financial management, impacting not only the business’s growth but also its fiduciary duty. Being mindful of, and addressing this is vital for the sustained success and legal compliance of your business.

Key Things That Will Help:

👉 – Scheduled Financial Reviews: Ensure that there is dedicated time blocked off for financial reviews. This could be weekly, bi-weekly, or monthly, depending on your business’s size and needs.

👉 – Delegate Non-Financial Tasks: Free up your time by delegating production or client management tasks to trusted team members or managers. This should be part of any business owners growth plan!

👉 – Automate Where Possible: Use financial management software to automate routine tasks like invoicing, expense tracking, and payroll.

👉 – Financial Goals Alignment: Regularly review and align or realign your activities with the business’s financial goals to ensure that your time is spent on tasks that contribute to these objectives.

👉 – Educate and Empower Teams: Train your team to handle certain financial aspects, like budget management within their departments, to distribute the financial responsibility.

👉 – Professional Assistance: Consider hiring a financial advisor or accountant who can manage complex financial tasks and provide expert advice (see here).

👉 – Fiduciary Responsibility Awareness: Stay informed about your legal and fiduciary responsibilities as a business owner to understand the importance of financial oversight.

👉 – Integrate Financial Management into Daily Operations: Make financial considerations a part of your daily decision-making process, rather than an isolated task.

👉 – Regular Financial Health Check-ups: Conduct regular financial health assessments to identify and address issues before they escalate.

👉 – Balance Short-term and Long-term Focus: While dealing with immediate client and production issues, also keep an eye on long-term financial planning and strategy.

Incorporating these practices means that financial management receives the attention it deserves, balancing day-to-day operational demands with the overarching financial health and compliance requirements of the business.

Final Thoughts

The key takeaway I want to give you from this article is the importance of adopting a holistic approach to financial management, one that encompasses not just budgeting and cost control, but also investment in growth, employee financial training, and aligning compensation with strategic goals.

Effective budget management is not just about keeping costs low; it’s about making smart investments that drive growth while maintaining a healthy cashflow. Tools like cashflow forecasts and management accounts are invaluable in providing the clarity and control needed to navigate the financial complexities of a growing business. Embracing methodologies like the ‘Profit First’ approach can revolutionise the way businesses view and handle their finances, ensuring profitability is at the forefront of every decision.